Case Study

Adaptive Reuse Development

Building information:

- Address: 1500 Broadway – Oakland, California, 94618

- Square Feet: +/- 91,045

- Owner: Equistone Partners in partnership with Hamilton Zanze

Terms:

Sale Price: $36,600,000

Price/SF: $402/SF

Seller Cap Rate: 4.01% (based on T12)

Seller: GSR 1500 Broadway Partners, LLC

Equistone Partners in partnership with Hamilton Zanze

Buyer: HighBridge Oakland, LLC

Highlights:

– We returned a total of $21,670,127 to investors

– 7.62 project equity multiple

– 6.08 investor equity multiple

– 56.83% investor IRR

– 64.51% project IRR

THE OPPORTUNITY

During the 2008 Recession we saw our fair share of failing businesses, imploding real estate projects and faltering financial institutions. United Commercial Bank (UCB) was one of many banks that went insolvent during this tumultuous era. .

East West Bancorp acquired UCB’s loan assets and hired a commercial real estate firm to sell 1500 Broadway in Oakland, California at a fraction of the pre-recession appraised value.

In 2009, there was limited market for occupancy and the sky seemed to be falling. With the odds stacked against us, Equistone Partners believed a market could be created to drive tenants to occupy a Class B property in Oakland amid this challenging time.

A Building with History

1500 Broadway is an iconic building with a storied history. It was originally built in the early 1920s as the home of The Roos Brothers department store. This classic building was eventually converted from a showroom to office space in the 1970s.

A local developer purchased the building in the late 1990s and had plans to connect the adjacent building together, along with a hotel. After excavating the space under the building for a subterranean garage the market took another dip during the dotcom bust of 1999. 1500 Broadway slowly began to show its unmaintained age.

Exceptional Location

The building facade was dirty and unkempt, but Equistone Partners looked beyond the exterior issues and discovered a structure rich with history, classic architecture and a world of potential. Our plan was to utilize its exceptional location, directly across the San Francisco Bay Bridge in downtown Oakland, and market it to a new wave of innovative companies.

OUR STRATEGY

To reinvigorate 1500 Broadway, Equistone Partners rebranded it as the “Gateway to Oakland and Uptown,” which included a business plan to drive value. It became the new alternative to run-of-the-mill Class A high-rise space, with exposed ceilings and historic architectural appeal. We introduced a different product that attracted tenancy, similar to San Francisco’s South of Market office conversions during the dotcom era.

OUR PROCESS

Equistone Partners placed the property under contract and promptly engaged one of our affiliate partners to assist with raising equity. Our plan was to remove years of drywall and drop ceilings, to expose the bare concrete and spectacular natural wood, in order to create an open and minimalistic layout in this majestic building.

- Created a business plan with our investors, who advocated our vision to make the purchase a reality.

- Raised additional capital for improvements, along with securing new debt from a regional bank.

- While under contract Equistone Partners approached the top floor tenant and renegotiated and extended the lease, which covered all expenses to operate the property, while minimizing investor risk.

- Installed new building mechanical systems to attract mid-size users for full or half floors.

- Secured tech tenant Visual Supply Co. (VSCO) that was attracted to the location, architecture, proximity to public transportation and fiber connectivity.

- Created a business plan with our investors, who advocated our vision to make the purchase a reality.

- Raised additional capital for improvements, along with securing new debt from a regional bank.

- While under contract Equistone Partners approached the top floor tenant and renegotiated and extended the lease, which covered all expenses to operate the property, while minimizing investor risk.

- Installed new building mechanical systems to attract mid-size users for full or half floors.

- Secured tech tenant Visual Supply Co. (VSCO) that was attracted to the location, architecture, proximity to public transportation and fiber connectivity.

THE RESULT

Equistone Partners worked with the founder of VSCO, architect and general contractor. Together we created a hip and cool tech space where employees would be excited to come to work. The concrete was exposed and the floors were updated using reclaimed wide plank hardwood, similar to San Francisco’s MOMA building. This created a rustic ambiance featuring natural material, metal and glass housed in a sleek and modern design.

The mezzanine and 2nd floors were connected, and the original ceilings were exposed and restored back to their original height, reminiscent of when the Roos Brothers first occupied the property in the mid-1920s.

THE ROI

Far from the top of the market in 2016, we decided to sell the asset to lock in a return for our investors. A local real estate entrepreneur saw the value that was created and following a flurry of competitive bids the building sold. The sale of 1500 Broadway returned a multiple of equity six times over the initial investment, returning $21.67 million to investors at an internal rate of return of 56.83%.

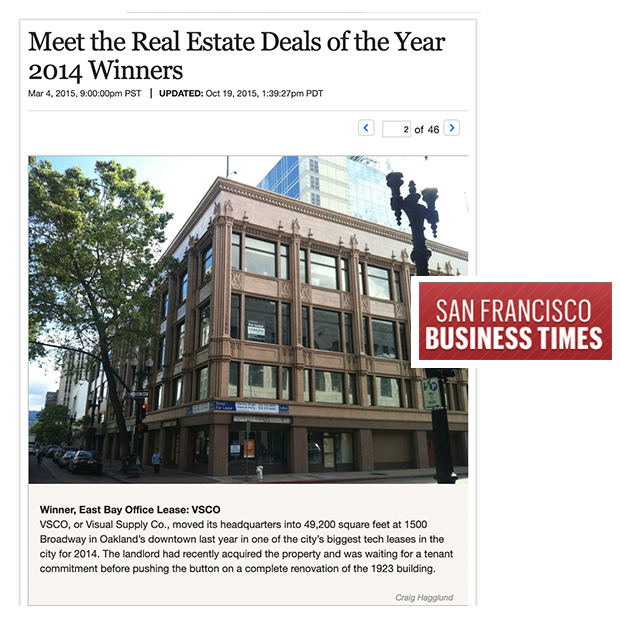

East Bay Real Estate Deal of the Year – 2014

In 2014, prior to the building’s sale in 2016, 1500 Broadway won the East Bay Real Estate Deal of the Year award for design and deal execution. The investors had faith in Equistone Partners and our vision for the property. They were handsomely rewarded with an award-winning building and double-digit returns.

Source: San Francisco, Business Journal, Meet the Real Estate Deals of the Year 2014 Winners – Mar 4, 2015