Case Study

Distressed Real Estate Investment Acquisition

Building information:

- Address: 80 Swan Way, Oakland, CA 94612

- Square Feet: +/- 50,000

- Tenants: Multi-Tenant

Terms:

- Type: Distressed Real Estate Acquisition of a Mid-Rise Suburban Class B Office Building

- Owner: Equistone Partners in partnership with Hamilton Zanze

THE SETTING

80 Swan Way in Oakland, California is an example of that coveted acquisition in the real estate cycle where a property is acquired for a fraction of replacement cost, due to external economic factors.

Back in 2009, when the financial cycle bottomed out, many buildings were in default on their loans. A 1980s office building at 70% vacancy in the Oakland airport market went to auction on the courthouse steps along with a variety of residential homes. Thankfully our competitors on hand were looking to acquire homes, not an office building.

Equistone Partners focused its sites on the 50,000 square foot office building. We were familiar with the market and had a strong plan of attack to lease up the vacant space and reposition the asset in the market.

THE BUILDING HISTORY

80 Swan Way was formerly occupied by Southwest Airlines and the highly desirable top floor was occupied by a regional accounting firm. Historically the neighboring areas of the building, located close to the Oakland Airport, experienced spill over demand from downtown Oakland. Southwest Airlines downsized in the area and left a large vacancy due to the economic downturn. The Oakland Airport market was experiencing a reverse migration back to the central business district. A flight to higher quality buildings began to take its toll on the area.

THE OPPORTUNITY

Equistone Partners forged a relationship with the main principals of the accounting firm located at 80 Sway Way, prior to it going to auction. Representation was secured to assist with the evaluation of a lease renewal or relocation within the building regardless of the auction’s outcome. An offer to acquire the property with the accounting firm in partnership was offered and considered as an option. The firm was disappointed with the former ownership’s lack of attention to the structure. The building owner defaulted on the loan, which lead to receivership and the eventual sale of the property. The firm’s lease would expire in four years, further impacting any future owner of the real estate.

THE STRATEGY

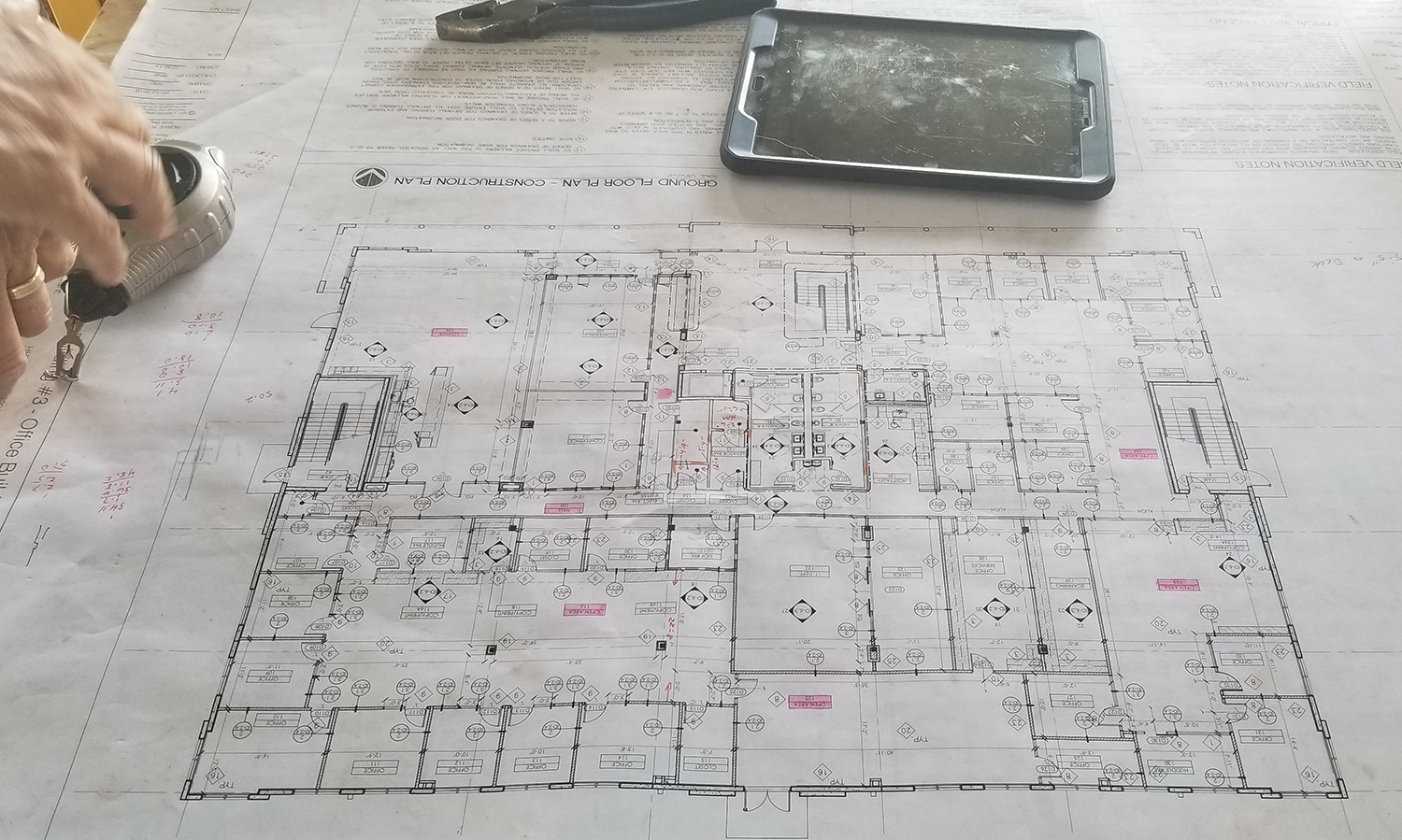

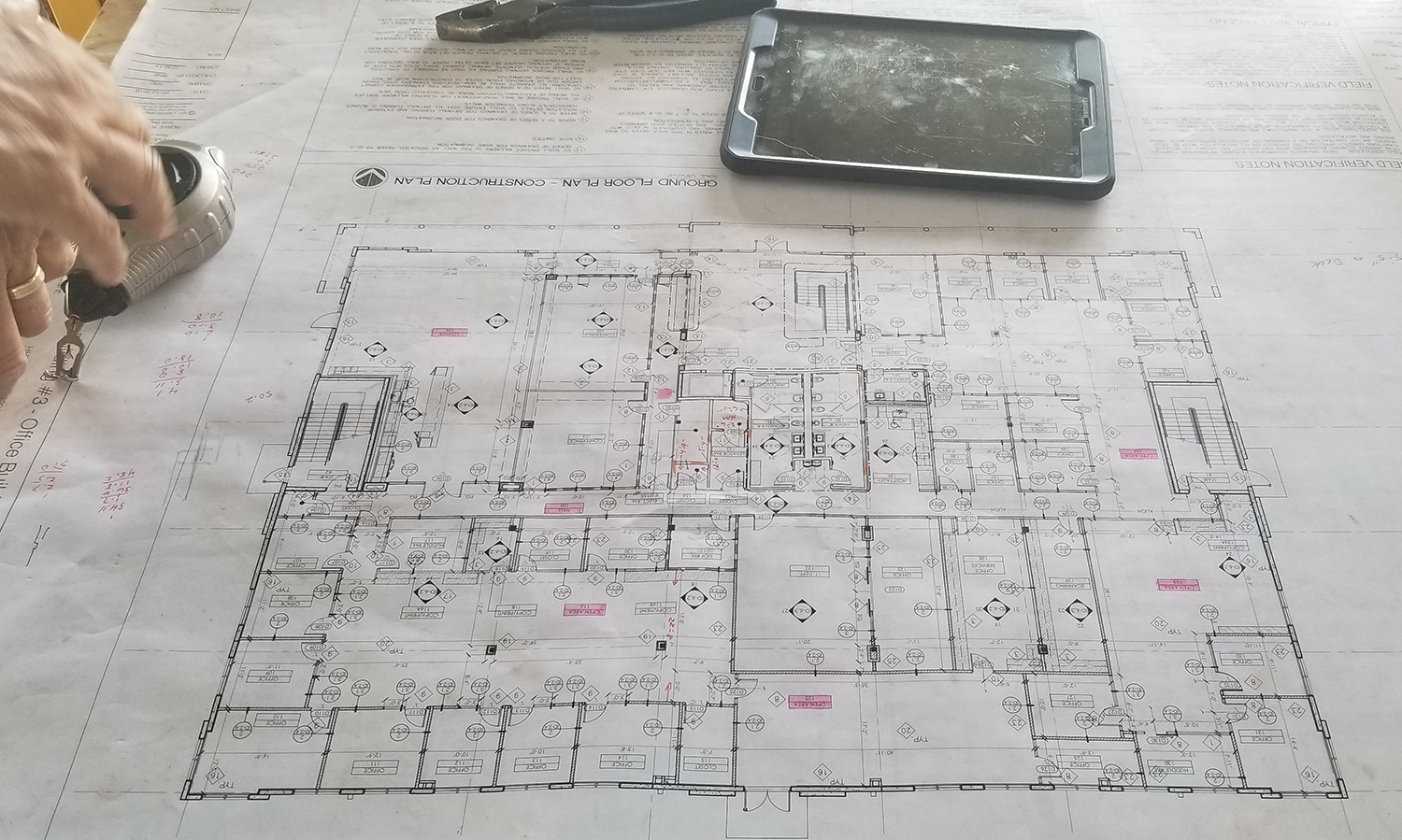

A capital improvement and marketing strategy was developed to update the building’s infrastructure and to find tenants that sourced employees from areas in the southern I-880 corridor. 80 Swan Way was surrounded by a sea of parking, close to major transportation arteries and two miles from Oakland International Airport, a perfect match for these companies.

THE PROCESS

The Equistone Partners principals, along with an affiliate equity partner, purchased the asset on the courthouse steps at a price of one quarter the cost of construction. We secured a technology company for the entire 2nd floor looking for exceptional office space and abundant parking for their employees and close proximity from the south I-880 corridor. Equistone Partners deployed an effective marketing strategy with the right product and amenities to attract established businesses to the asset. The largest conference room in the building was repurposed as a common amenity and a failed café was turned into a state-of-the-art gym. High speed wireless fiber was installed to provide the best connectivity for tech-driven companies. We updated the landscaping and added new lights to the parking lot, which was also cleaned and re-surfaced.

THE RESULT

Equistone Partners completed multiple leases and stabilized the asset. The capital improvements, common conference room, gym and new tenancy breathed new life into the building. The accounting firm that occupied the top floor decided to move downtown at the end of their lease, which ended up being a fortuitous move for all. By that point we had secured leases for the remainder of the building, easing the impact to vacancy.

The newly renovated building was illustrious and the preeminent floor with outstanding views was now available for lease. The timing was right and the building was marketed for sale to target owner-users who wanted a high-profile top floor space, with other tenancy on lower floors allowing for expansion as leases expired. Owner-users with the intent of occupying 51% of the building typically are able to obtain SBA loans from the government at higher leverage.

A local company was in the market for an updated and partially leased building with space for its own occupancy. We delivered a deal that was a homerun for the new owner and achieved a return four times the initial capital invested for Equistone Partner’s investors, a win-win.