Case Study

Raw Land Acquisition

Building information:

- Address: 10360 West State Road 84, Ft. Lauderdale (Town of Davie), Florida

- Square Feet: +/- 2.5 Acres

- Owner: International Ownership

- Tenants: Raw Land

Terms:

- Type: Raw Land in the Path of Development for Kelley Kronenberg Headquarters Relocation

- Development Partner and Advisor: Equistone Partners

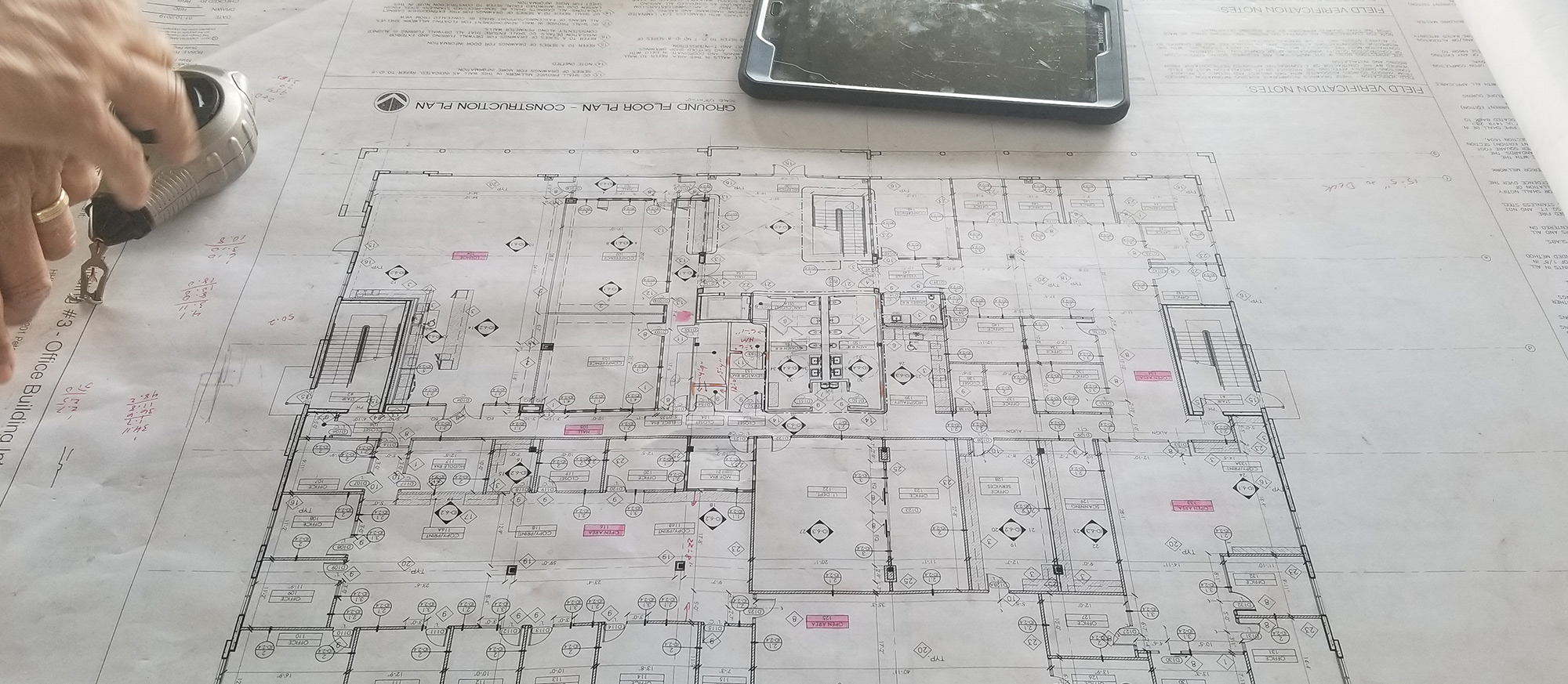

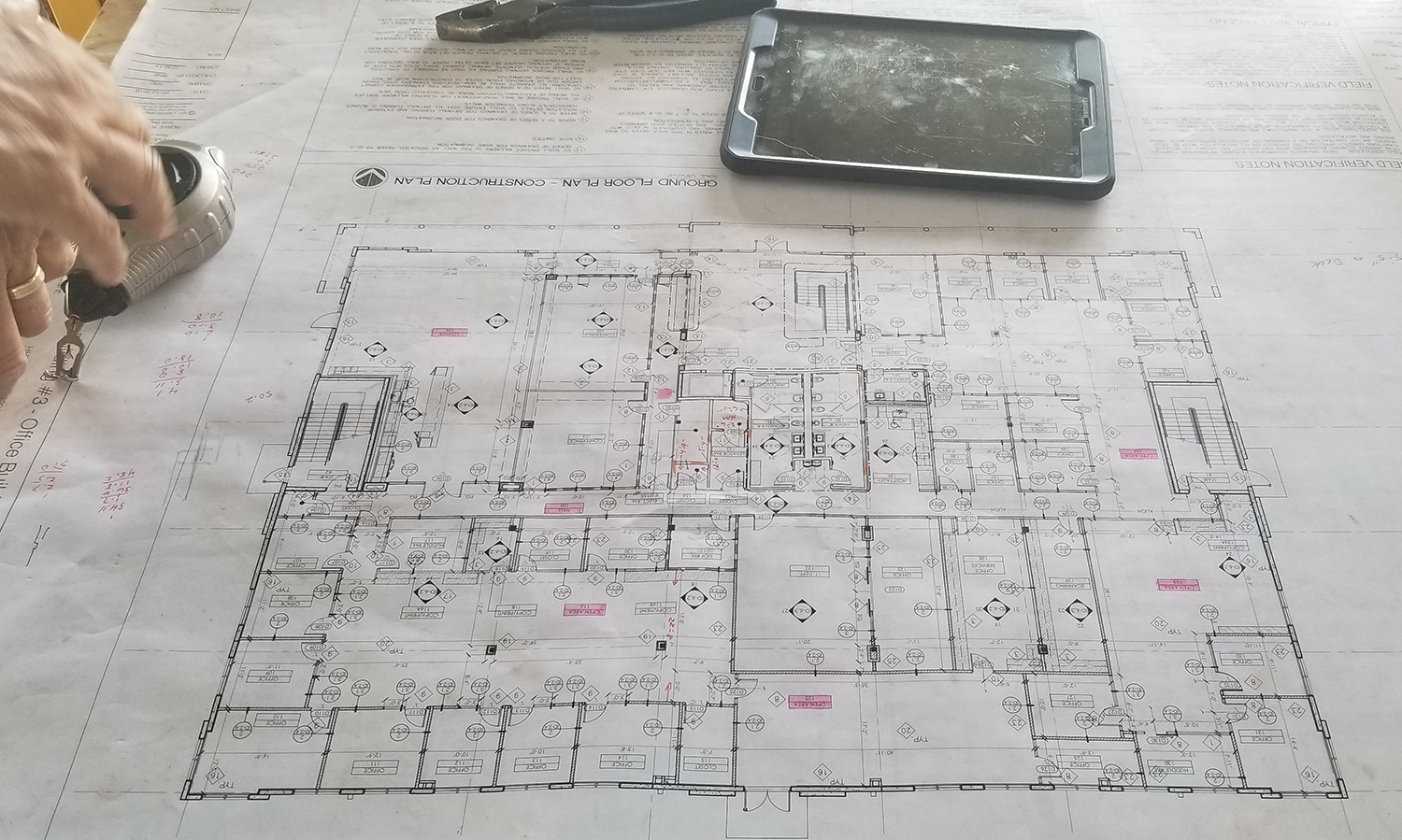

- General Contractor: Miller Construction Company

- Master Architect: Cabrera Ramos Architects, Inc.

THE SETTING

This case study outlines the facility evaluation process and sets the stage for the future development of the Kelley Kronenberg Law (KKL) headquarters’ building. The strategy and process are a collaboration between Equistone Partners development and consulting services, as well as our robust brokerage and advisory services. Prior to the occurrence of any development or predevelopment, a site is selected and placed in a favorable contract. The site selection process often exceeds the time it takes for planning, evaluation, due diligence, pricing and construction. It is imperative to engage the right team for this journey.

Our engagement with KKL started four years prior to development of their headquarters building in South Florida. Equistone Partners was hired to conduct an evaluation for new office space, deliver renewal options and procure potential land or existing buildings suitable for development. The KKL partners saw the value in maximizing control over their own occupancy and entrusted us to seek and secure opportunities for consideration. Sometimes the path that is less traveled can yield great benefits, which KKL discovered through our engagement.

THE OPPORTUNITY

Equistone Partners has access to multiple listing services giving our clients a wide variety of options, but that alone does not provide an execution strategy. Our value proposition has changed in the information age, but what has not waivered is our ability to deliver an overall strategy by paying close attention to our clients. We listen, formulate a plan and execute. This is our mantra, whether engaged as a brokerage professional to secure property, development advisor, consultant or a general partner.

THE STRATEGY

Kelley Kronenberg Law grew steadily over the years until they became the largest tenant in the building taking over multiple floors. As they grew and expanded, the lease was amended on seven different occasions. These modifications spanned multiple ownership groups, who had purchased KKL’s income stream at various times, as the building changed hands. To be an effective partner for the client, Equistone Partners needed to understand all of the intricacies of the master lease, but also the lease amendments and modified language inserted from various new owners over the years. There are multiple leasing approaches to consider to be an effective service provider and partner. These include seven key strategies in evaluating a facility plan outlined below.

THE PROCESS

Equistone Partners conducted a full survey of all available alternative office locations in the marketplace. We also assembled every comparable lease signed in the area and toured several available locations, while engaging in renewal discussions with the landlord.

Simultaneously, we completed a comprehensive study of all the land and existing buildings that met KKL’s specific criteria. The properties that made the list were either for sale at the time or fit the requirement parameters and were off market. Our intent was to build a ground up state-of-the-art facility or buy and complete an adaptive reuse of an existing building by modifying it to suit our client’s needs. We have a firsthand understanding of brokerage, finance, ground-up development and adaptive reuse of existing structures. As an owner and advisor, we are able to find opportunities on and off market and develop a road map that delivers turnkey solutions to our clients.

OPTIONS

Blend & Extend/Early Renewal: The basis for this strategy is reducing the current rent per square foot, requesting concessions, improvements, HVAC work, new base year etc., while extending the current lease. This negotiation may be in combination with free rent or partial rent concession for immediate relief, while allowing the landlord more stability with a longer deal. This may also include a reduced or increased footprint.

Lease Restructure: This approach contemplates reducing the per square foot occupancy costs through rental reduction without necessarily extending the current lease term. This scenario is typically effective when the underlying tenant has limited exposure, due to a small security deposit or limited credit, and is able to walk away. If the lease is not personally guaranteed and/or the underlying tenant is reaching the point of insolvency, this circumstance may ultimately lead to a lease termination.

Lease Termination: This tactic eliminates the current lease entirely. It’s effective when the underlying tenant has little or no security deposit or letter of credit, individuals of the corporation have not signed personally on the lease and/or the underlying tenant may be reaching the “zone of insolvency.” The tenant may have to make some payment to terminate the lease, depending upon solvency, but it is likely the amount could be well below the net present value of future payments on the lease.

Sublease: This strategy is to place the space, or a portion of the property, on the market for sublease and attempt to find a subtenant that has equal or better credit than the underlying tenant. The occupant remains the guarantor of the lease and in the event the new subtenant does not make payments on the lease, the underlying tenant is still responsible for these payments.

Sublease and Restructure: This method places the property, or a portion of it, on the market for sublease to attempt to find a subtenant that has equal or better credit to the underlying renter. Once a suitable subtenant is found, a direct deal is negotiated with the landlord to remove the current resident from the lease obligation, or a portion in the event of partially taking over the space. The new lease replaces the former tenant lease, relieving the former occupant from rental obligations.

Evaluation of a Renewal/Relocation: The idea behind this action evaluates a space occupancy analysis of the most critical aspects of a new facility. We select and identify opportunities in the market, tour opportunities, submit letters of interest, evaluate the responses and drive value through this process. This strategy would include evaluation of your existing facility at new market terms, taking into account all rental concessions, free rent, move allowance(s), tenant improvement packages, favorable lease language available and more, in comparison to remaining in the tenant’s existing facility.

Evaluation of a Lease/Purchase:This strategy evaluates base rent and operating expenses paid through tenancy over a ten-year period in comparison to full ownership in a general partnership, or partial ownership in a limited partnership (or some other agreed to structure) of a building over that same time period. This procedure would be included with the Evaluation of a Renewal/Relocation to assure that terms (rent, rental concessions, free rent, move allowance, tenant improvement packages, favorable lease language etc.) for a new lease would be market driven, benefitting the client through ownership of the property.

Equistone Partners completed a full review of KKL’s business case and identified multiple strategies to pursue. The least traveled path was the right lane to take for this project, which included both the Evaluation of a Lease/Purchase and the Evaluation of a Renewal/Relocation.

THE RESULT

Multiple opportunities were identified and vetted through our strict criteria and were selected for consideration. The winner was a property in an approved office/flex/industrial park. Equistone Partners applied for 100% allocation of office to the parcel, modifying the former partial retail/flex use and closed on the property with a financial partner, SunTrust Bank in partnership with the SBA (Small Business Administration Loan). We also negotiated an option on the adjacent land for future construction of a second phase and are constructing a second building as a general partner with the firm. The first building constructed won the 2019 South Florida Craftsmanship Award for Overall Craftsmanship in a Commercial Project Award.