Real Estate Investment Repositioning

Case Study

Real Estate Investment

REPOSITIONING

Building information:

- Address: 140 – 160 Franklin Street, Oakland, CA 94612

- Square Feet: +/- 55,000

- Tenants: Multi-Tenant

Terms:

- Type: Real Estate Investment Repositioning

- Owner: Equistone Partners in partnership with Hamilton Zanze

THE SETTING

Back in November of 2007, life was good and it seemed that nothing would stop the economic boom. Equistone Partners was just formed in California and we were eager to find a project in an up-and-coming area with a path to raise limited partner equity and acquire an asset. We found the perfect choice in a well-located property in Oakland’s Jack London Square neighborhood, adjacent to the inner harbor.

The property is one block from a large Class A office complex on the waterfront, where an institutional equity partner committed a significant investment in the area. Jack London Square is an alternative to downtown Oakland, where architects, engineers, law firms and sole practitioners would gather to grab coffee or lunch in an atmosphere away from the direct hustle and bustle of downtown. The location is idyllic with clean and clear ocean breezes; the perfect setting for a successful venture.

THE BUILDING HISTORY

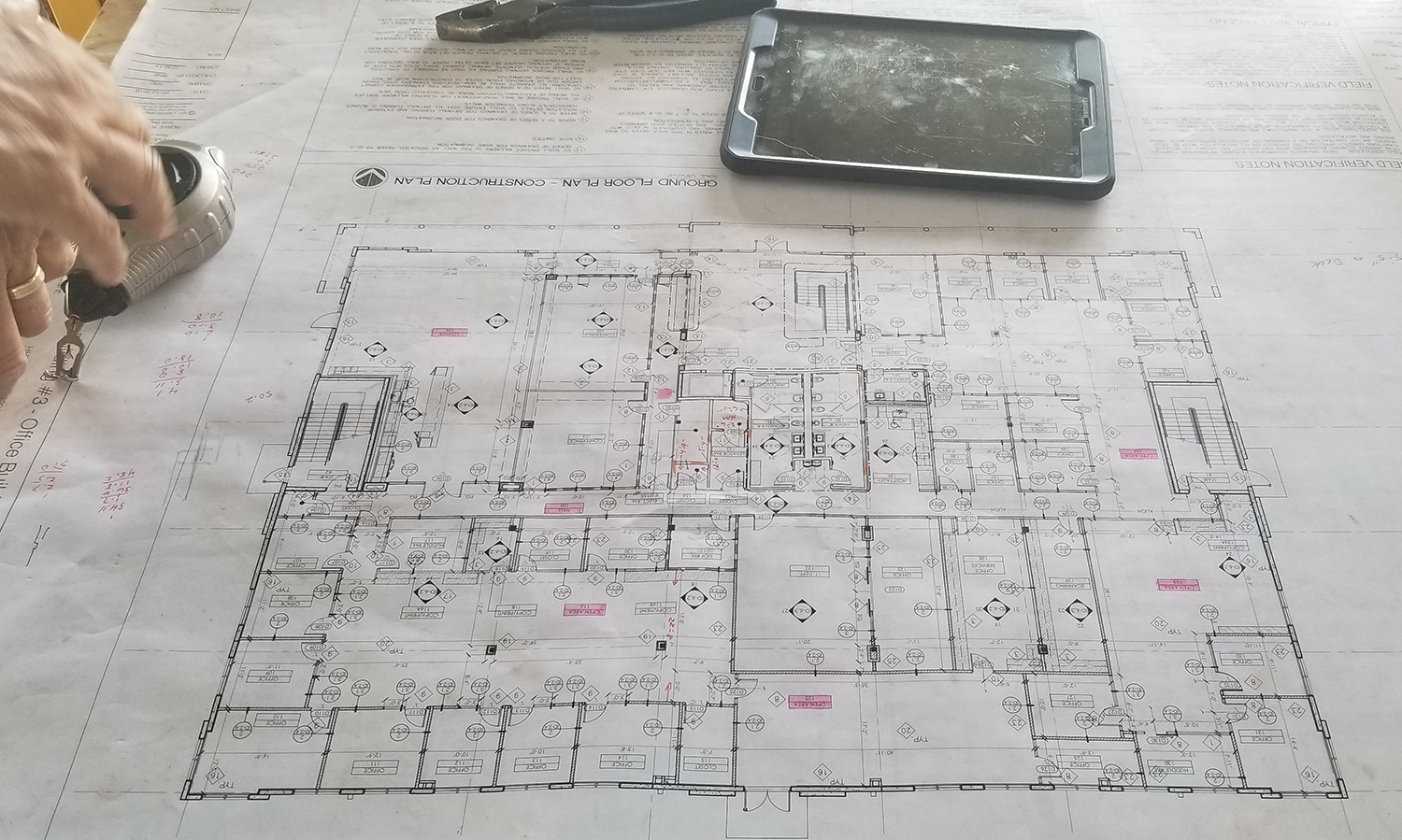

140-160 Franklin St. was redeveloped in the 1980s by adding a new three-story professional office building to a site that included a one-story warehouse along with a brick and timber three level building constructed in the 1930s. The brick and natural wood 1930s structure on the corner was full of character. The adjacent 1980s structure was joined by a two-story wood frame addition over a one-story warehouse building. It was clear the redevelopment in the 1980s was well-executed by its owner, a renowned architect. The property was operated by a family office and overseen by a local third-party manager.

THE OPPORTUNITY

When the original owner/architect passed away, the family office continued to lease the property and did its best to remain competitive in the marketplace. Honestly, the building was trapped in the ‘80s and the family was not able to keep the property up-to-date. They were resistant to change predominately due to the legacy of the family’s patriarch, who designed the building. The property declined over the years and fell out of touch in comparison to other freshly designed properties in the area. When the family decided to put the property on the market, the real estate community didn’t embrace the opportunity. Unfortunately for the ownership, it was not widely marketed on national multiple listing services.

THE STRATEGY

Equistone Partners saw a great piece of real estate that was challenged by ineffective marketing and acquired the property at a price well below replacement cost. Our strategy was to place the property in contract and raise limited partner equity, inclusive of all capital required to reposition the asset.

The final business plan was formulated and Equistone Partners acquired the property. First on the list was to reposition the well-located real estate asset in the market, coupled with a plan to drive economic value through strategic investment and capital expenditure. As we geared up for our original plan in 2008, the bottom fell out of the market, demand waned and supply increased. Failure was not an option for Equistone Partners, but the business climate was extraordinarily dire.

Due to the economic collapse in 2008, return on capital was a term of the past. Survival was key and a return of capital was targeted. Equistone Partners created a new strategy to ensure its investors not only preserved their capital but provided a path to a return on their investment.

THE PROCESS

Equistone Partners surveyed every competitor in the marketplace and noticed that smaller single offices catering to sole practitioners and small firms were limited, while large blocks of space were sitting on the market. Environmentally friendly “Green” buildings were at home in the neighboring city of San Francisco, but chiefly limited to expensive Class A properties.

The business plan considered the new economic reality of a global recession. What if we pursued our original strategy, but amplified it by adhering to the leadership for Energy, Efficiency and Design (LEED) standards, so that the property could differentiate itself from the pack as a “Green” building? An idea was born. As we improved and updated the building, the larger spaces were divided into easily expandable smaller office units. Rather than wait for tenants to provide improvements through an allowance, the suites were spec built up front to provide ease of occupancy and cost control. The spaces were move in ready with high speed fiberoptic connectivity in every suite. A common conference room and kitchen was built to serve these “micro suites,” as a community was formed around green construction and like-minded companies that desired a clean and innovative work environment.

THE RESULT

140 – 160 Franklin St. remained 93% occupied through the economic downturn of 2008. When global liquidity tightened and financing was scarce, the project delivered not only a return of investment capital, but a return on capital at a time when many buildings were running at only 50% occupancy with negative cash flow. The property was bought prior to a recession and was sold post-recession, returning initial equity back to investors plus a return on capital, a rare and respected feat in that economic environment.

Great real estate that is well located can be impacted by outside factors, like the circumstances that affected the prior owner’s family after he passed away. They did not want to make changes to improve the property for fear of affecting their late father’s legacy. Real estate can also be severely jolted by external factors like the economy. Equistone Partners recognized the signs and revised the original strategy to remain effective in a changing market.

Recent Comments